The Debt Sophistication Dilemma That Can Become a FDCPA Compliance Nightmare

Along with our emphasis on clear consumer communications and optimal compliance strategies, our knowledgeable staff at Intelligent Contacts also focuses on several intangibles. For example, it's not enough to approach compliance strategies based on regulation (FDCPA) and DNC compliance liability. Your analysis should also consider trial lawyers who can find several ways to take your organization to court.

Case in point – Midland Credit Management has a whole new understanding of the term, “least sophisticated debtor” when it comes to their collection letters.

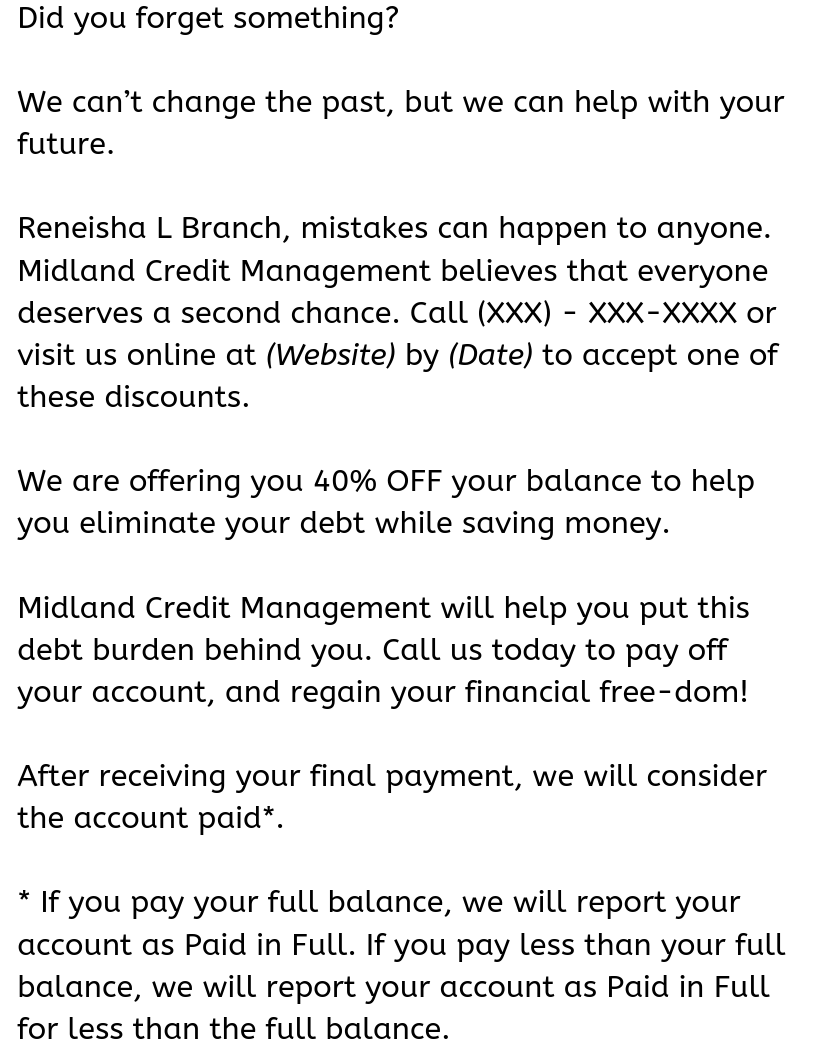

Can you spot the compliance challenges in this letter?

The Fair Debt Collection Practices Act violation in question focused on the the “confusing” context of the word “report”. Specifically:

Not effectively explaining the difference between “paid in full” and “paid in full for less than the balance” and potentially violating Sections 1692e and 1692f of the FDCPA.

Pennsylvania Distict Judge Mark Kearney agreed with the Section 1692e violation on the grounds that letter did not specifically state whether the “reporting” was going to the original creditor or a credit bureau.

How do I protect my organization from the “most sophisticated trial lawyers”?

After all, trial lawyers not only know how to find ways to file compliance-related lawsuits, they can also train debtors to lure debt collection companies into traps involving the slightest hint of confusion or deception.

We're not a law firm or a team of attorneys, and we don't give legal advice. However, we can help companies work to avoid the trends surrounding serial litigators that contribute to compliance lawsuits we see every year. It's one of the reasons we take a thorough and personal approach to client support and service—no specific level of sophistication required.