OMNICHANNEL | 5 MIN READ

What An Omnichannel Collection Approach Looks Like

When it comes to accounts receivable management, what does an omnichannel collections strategy look like?

While phone calls and letters remain the most common methods for contacting and collecting on past due accounts, changing consumer behaviors are requiring businesses to adopt a more omnichannel approach. Collecting from today’s consumer often requires multiple touch points that may start with a call or letter, but also includes email, text messages, or even a web chat.

Sure, there is a segment of your accounts that will answer a phone call or respond to your letter with a payment, but there’s still a significant number of consumers who are motivated more by convenience and flexibility. This group represents a growing slice of collectable debt that ends up unpaid when you overlook the power convenience has on consumer behavior.

What they're asking

Can I set up my own payment plan?

**********

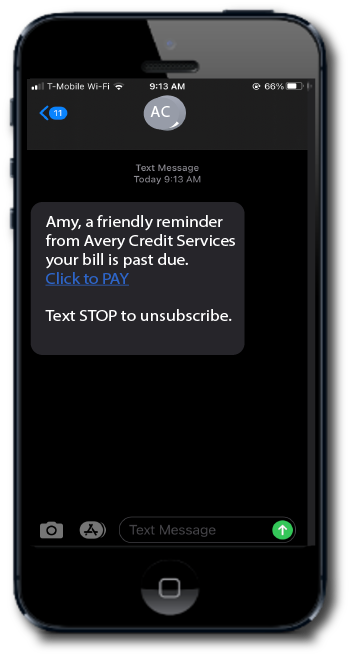

Can you communicate or exchange information through digital channels?

There was a time when the idea of sending debt-related communication via text or email caused compliance managers to wake up in a full sweat.

There was also a prevailing thought consumers would recoil at receiving a text or email from a debt collector. However, times have changed on both fronts.

Can consumers resolve their balance without speaking to anyone?

An omnichannel approach in accounts receivables encompasses both communication and payment channels. But today, simply providing consumers a way to pay online isn't enough. They want flexibility in how they resolve their balance.

In the past, this may have included working out a fixed installment plan over the phone. But what today's consumer really wants—and what actually motivates them to resolve their balance—is full payment autonomy.

Featured Topics

ARM Industry Topics

Healthcare Industry Topics

Contact Center Solutions & Topics

Auto & Predictive Dialing

Stealth Voicemail

Payment Topics & Solutions

Compliance & Data Security

Featured Topics

ARM Industry Topics

Healthcare Industry Topics

Contact Center Solutions & Topics

Auto & Predictive Dialing

Stealth Voicemail

Payment Topics & Solutions

Compliance & Data Security

Can they pay you with just a few clicks from a mobile device or a QR code?

Using a QR code you can quickly turn your paper statement into a mobile payment. With QR code readers built directly into mobile device operating systems, this functionality is now mainstream.

As you see in the video on the LEFT, a QR code is the quickest and most frictionless way for a consumer to pay you. This is omnichannel on STEROIDS.

What they're asking

Can you just email or text that to me?

**********

A phone call? No thanks. Just text or call me.

Let's face it, people barely answer the phone anymore. Most even prefer that a friend or family member text a quick reminder to them rather than call.

Why should a payment reminder be any different. Personal preferences aside, here's a few important facts about texting today:

- Virtually no one has to pay for text messages anymore

- All age groups communicate via text

- CFPB's Reg F Final Rule approved its' use for debt collection

Want to know more?

Whether you're looking to upgrade one part of your communication or payment process or the whole enchilada, we can help!

CASE STUDY