AI IN DEBT COLLECTION | PART 1

How to Use AI to Structure and Analyze Omni-Channel Communications

Step 1

Gathering Messages

When people talk to your company through calls, texts, chats, or emails, those messages are collected and stored some place.

The first step in AI-driven communication analytics is getting that data organized in one place.

Step 2

Sorting Feelings

With that data organized, AI (machine-learning computers) can then analyze each of those interactions and provide an overall sentiment analysis. Was the customer (or agent) satisfied, angry, confused, or frustrated.

Step 3

Finding What They Want

AI also analyzes interactions to figure out what the customers want. Do they need to make an appointment, pay a bill, ask a question, or voice a complaint?

Identifying what's important to a customer early leads to better outcomes and greater overall satisfaction.

Step 4

Identifying Key Words

The AI finds, tags, and categorizes important words in the messages to better direct inquiries, flag conversations for escalation, or to cue agent responses.

Words like “payment,” “appointment,” or “help,” can be used to route customers to right department. While “lawyer,” “lawsuit,” or profanity of any type will flag that communication for escalation or further agent training.

Step 5

Planning Ahead

With AI-driven communication analytics, the end goal is to be able to provide better service to customers by anticipating what they need before they ask.

With the help of AI, businesses can “predict” how customer segments are likely to respond, when is the best time to engage, and what communication channel (email, phone, SMS, chat) is their preferred method of interaction with your business.

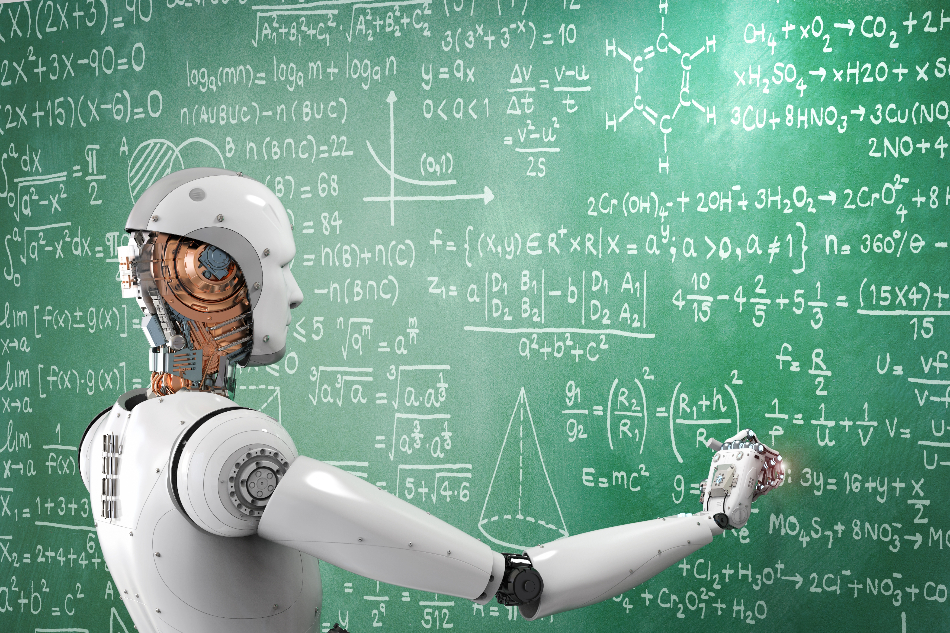

“Artificial intelligence (AI) is continuously reshaping how businesses operate across diverse industries. For debt collection agencies, AI represents a promising frontier. With its robust capabilities, AI offers solutions to the age-old problems of manual data entry and analysis, transforming the industry’s trajectory.

In debt collection agencies, data entry traditionally involves manually inputting vast amounts of debtor information into databases. This approach is often fraught with errors, inconsistencies, and inefficiencies, not to mention the considerable time, effort, and resources it demands. Enter AI.

Using AI to Structure Data for Greater Accuracy

Through automated data entry systems powered by machine learning algorithms, agencies can significantly streamline their data entry processes. Optical Character Recognition (OCR) technology, a subset of AI, can scan, recognize, and interpret data from physical or digital documents. This data can then be added to an agency's system of record–thereby eliminating human errors and ensuring higher accuracy levels.

Machine Learning algorithms can also learn from previous mistakes or inconsistencies, constantly improving their performance over time. This functionality reduces the need for manual corrections, leading to better operational efficiency.

Using Natural Language Processing (NLP)

AI, through Natural Language Processing (NLP), can also handle unstructured data, such as emails, phone call transcripts, or social media conversations, often a challenge for manual data entry. By converting this data into structured formats, AI can help agencies leverage a wealth of information that was previously difficult to tap into.

Analyzing Data at Scale

Manual data analysis often involves sifting through vast amounts of data to uncover insights, identify patterns, and make informed decisions. This approach is time-consuming and not always precise. AI has the potential to transform this landscape dramatically.

AI algorithms can process and analyze large volumes of data at unprecedented speeds, offering insights that humans might miss. They can identify patterns and trends in payment habits, debtors’ behavior, or success rates of different collection strategies.

Leveraging Data to Predict Future Behaviors

Using AI, predictive analytics becomes a reality for debt collection agencies. It can help predict a debtor’s likelihood of paying back based on historical data, enabling agencies to prioritize their resources more effectively. Furthermore, AI can help tailor personalized debt repayment plans based on a debtor’s profile, enhancing the chances of successful debt recovery.

In conclusion, AI has the power to revolutionize the way debt collection agencies handle manual data entry and analysis. By automating these processes, AI can save time, improve accuracy, and offer deeper insights. The impact is profound: higher operational efficiency, better allocation of resources, and increased success rates in debt recovery.

Note: The steps outlined above are a general guideline for structuring and analyzing customer communication data using AI for the healthcare and debt collection industries. The actual implementation may require customization based on specific business needs and data characteristics.

Want to know more?

Whether you're looking to add AI or machine learning into your billing process or just want to increase collection efficiency overall through automation and digital communication, we can help!

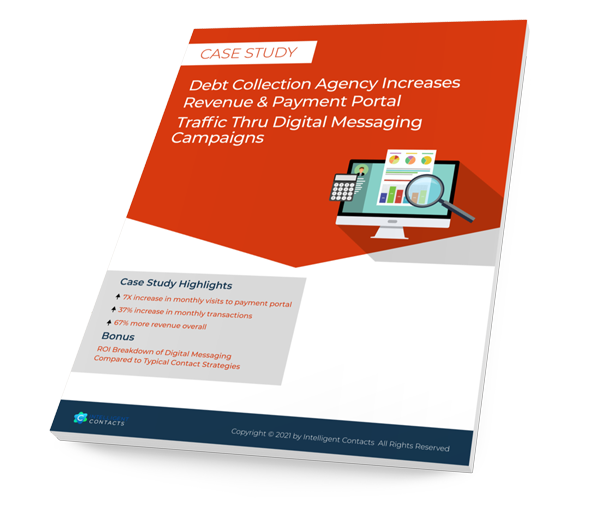

CASE STUDY

A leading third-party accounts receivables company was searching for a more profitable way to engage consumers with special discounts and settlement offers.

5 KPI Metrics You Should Be Tracking

Is your company missing its' revenue numbers and you have no idea why? Well-defined KPIs allow owners to measure and track the underlying operational objectives critical to business success.