DIGITAL DEBT COLLECTIONS | 10 MIN READ

How to Drive Consumers to Your Payment Portal

A consumer portal provides a convenient way for a consumer to view, pay a bill, or manage other aspects of their account, without having to speak to anyone over the phone. However, simply having a portal doesn't guarantee consumers will use it. In this article, we'll identify the most effective ways to drive consumers to your payment portal.

The self-service aspect of a portal is particularly important in the debt collection industry. Studies and polls have shown that when it comes to paying a debt, the vast majority of consumers would rather not speak to a collector if possible.

For a business, a portal is also appealing because it handles a number of daily tasks and transactions that would otherwise consume the time of staff.

On its face, a portal is one of the rare examples in business of a “win-win.” But as many businesses find out, dropping a “pay now” link on your website or the portal URL on a statement or collection letter, doesn’t really move the needle.

Let’s discuss some tips and best practices for not only getting more consumers to your portal, but converting those visits into payments.

“Marketing” Your Portal Effectively is a Company-Wide Campaign

Your portal is no different than any other product a company creates to make the lives of its customers easier. By following through on a few basic principles of product marketing, you can realistically expect to double the amount of consumers visiting your portal.

Step 1: Craft Your Offer and Elevator Pitch to Consumers

First, you’ll need a clear and concise description of your offer. What’s the real benefit or value of your portal? Essentially, you’re selling time and control—two of the most universally-valued commodities on earth. If your pitch leads with that, you’ll always have takers.

Featured Topics

ARM Industry Topics

Healthcare Industry Topics

Contact Center Solutions & Topics

Auto & Predictive Dialing

Stealth Voicemail

Payment Topics & Solutions

Compliance & Data Security

Here’s a few ways to express your offer of time and control:

Your portal saves the consumer time by offering the quickest and most convenient way for a consumer to see a balance or make a payment. In just a few clicks from an email or text, they can pay from a smartphone.

You’re also offering them control by providing on-demand access to manage a potentially significant financial obligation themselves—on their own time and without having to speak to anyone.

Make sure your Call To Actions (CTAs) reflect your portal’s benefits of time and control:

"No time to call? Pay online! Here's a link!

"Need to check your balance or payment history? Visit our portal HERE!

Statements & Letters

You’d be surprised to know how much influence the layout of a letter or billing statement has on consumer behavior. Since this is an area of revenue cycle or the collection process you have direct control over, this is your first chance to “market” your portal.

First and foremost, whatever changes you make to your letter or statement should be cleared by your compliance department. You want your letter to lead a consumer to the most convenient and efficient ways to resolve their issue, but that should always play second fiddle to your required legal disclosures under the FDCPA and CFPB.

Answering the questions, “What is this,” and “what are my legal rights and recourse,” are the main event. But once those questions are clearly addressed as the headliner, there’s still ways to present your portal as the consumer’s best option to resolve their account.

%

Of consumers say they would rather pay online than speak to an agent

%

Of payments made thru collection agency payment portals are made from mobile devices

- hList your portal as the 1st option in ways to contact you

- Make your portal option visually stick out by using color or a shaded box

- Stress the convenience of self-service and 24/7 access to their account

- Include a QR Code that links directly to your portal

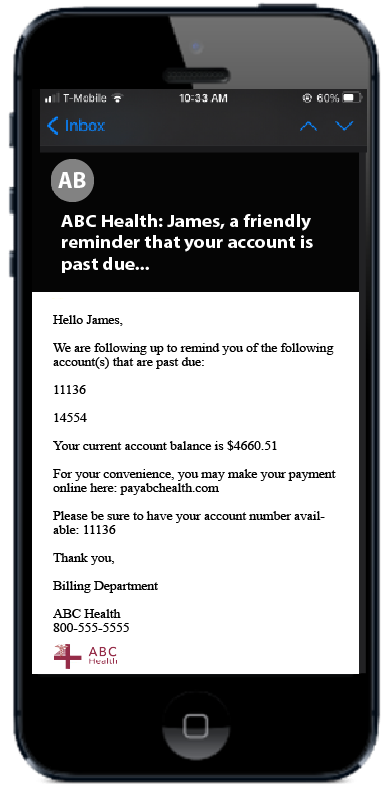

Email and SMS Messaging Campaigns

As we detailed in THIS CASE STUDY, email campaigns (to consumers you have consent to email) is the undisputed champion method for driving consumers to your portal. Send out 500 emails and within minutes you’ll likely have 75 to 200 consumers clicking through to your portal. It’s also important to note, that 70-80% of those consumers will be visiting from a mobile device.

Because the cost to send bulk emails is extremely low when compared to traditional outreach methods, even campaigns that only convert 3-5% still produce solid ROI.

SMS, or text message campaigns, also produce significant ROI. The delivery cost is a bit higher, but on average, SMS messages are seen quicker and links are clicked at higher rates than email.

Agent Buy In

I mentioned at the top that driving more consumers to your payment portal is a company-wide campaign. Nowhere is this more apparent than during a phone call between an agent and consumer.

If an agent can think of your payment portal as a friend and not a competitor, he or she will recognize moments within a conversation where self-service and convenience can “close the deal.”

Train agents to recognize consumers who aren’t comfortable answering questions on the phone and might respond better through a non-confrontational channel like a portal. Or, train agents to use a consumer's frustrations or busyness to present a more convenient method of handling their debt.

Agent: “If you’re not comfortable discussing this over the phone, you can always see all of the options available through our consumer portal…”

“I understand that your time is valuable…”

“It sounds like now is a bad time…”

“I realize this a lot to think through…a lot of this information can be accessed through our consumer portal…”

You can also incentivize agents to push consumers to your portal by giving them a personalized link that can be tracked and attributed to them when payment is made.

Agent: “Sure, you can pay online. Would you like me to email or text you the link?”

Search Engine Optimization

Believe it or not, some consumers will avoid your calls and ignore your letters only to decide one day to pay you. Some will look around the house for your letter or statement, or scroll through their missed calls to find your number, but a large percentage will search for you online.

So, an often overlooked way to drive more traffic to your payment portal is to make sure your site shows up as a top result when a consumers searches.

On average, between 5-8% of all portal traffic comes directly from a search engine query.

It’s likely a consumer is searching for you from memory and won’t enter your company’s name perfectly. What do consumers see when they do a broad search for your company?

Your Business Name: Avery Credit Services, Inc.

Google: Avery Collection Agency

Ideally, you want your payment portal and your corporate website to be the top 2 results. To do that, you’ll want to make sure you include common variations of your company’s name in your page titles, H1 tags, or meta descriptions.

Offer more “service-related” features

If your goal is to drive more consumers to your portal, then it only makes sense that giving them other reasons to visit will help achieve that goal. In fact, on average consumers who make a payment through a collection agency portal had already logged on 2 or 3 times before.

What are they doing?

- Logging in to see a special offer

- Or to submit a dispute

- Exploring all available payment options

- Viewing a copy of their original bill or collection letter

A consumer portal provides a convenient way for a consumer to manage all aspects of a past due account on their own schedule and without having to speak to anyone over the phone. As studies and polls have shown that when it comes to paying a debt, the vast majority of consumers would prefer to handle the matter through convenient, self-service channels.

A feature-rich, consumer-centric payment portal has shown to cut collection costs in half by transferring a significant amount of repetitive agent activities to self-service. Intelligent Contacts’ Intelligent Portal is the ARM industry’s most powerful consumer-facing payment tool on the market.

Looking for a payment portal consumers actually want to use?

Or any of our other award-winning communication and payment tools uniquely created for the healthcare and accounts receivable space! We can help!

CASE STUDY