Closing the Revenue Cycle Loop Thru Omnichannel Payment Journey Personas

What does an Omnichannel Contact & Payment Strategy Look Like?

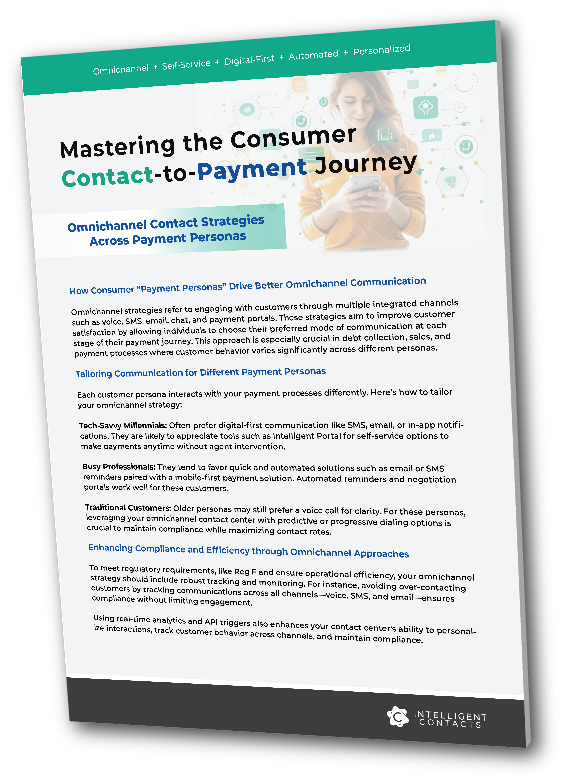

Omnichannel strategies refer to engaging with customers through multiple integrated channels such as voice, SMS, email, chat, and payment portals. These strategies aim to improve customer satisfaction by allowing individuals to choose their preferred mode of communication at each stage of their payment journey. This approach is especially crucial in debt collection, sales, and payment processes where customer behavior varies significantly across different personas.

For example, some consumers may prefer receiving payment reminders via SMS, while others may prefer email, or an automated voice reminder, or in some cases, a phone call.

Tailoring Communication for Different Payment Personas

Each customer persona interacts with your payment processes differently. Here’s how to tailor your omnichannel strategy:

Tech-Savvy Millennials: Often prefer digital-first communication like SMS, email, or in-app notifications. They are likely to appreciate tools such as Intelligent Portal for self-service options to make payments anytime without agent intervention.

Busy Professionals: They tend to favor quick and automated solutions such as email or SMS reminders paired with a mobile-first payment solution. Automated reminders and negotiation portals work well for these customers.

Traditional Customers: Older personas may still prefer a voice call for clarity. For these personas, leveraging your omnichannel contact center with predictive or progressive dialing options is crucial to maintain compliance while maximizing contact rates.

Featured Topics

ARM Industry Topics

Healthcare Industry Topics

Contact Center Solutions & Topics

Stealth Voicemail

Payment Topics & Solutions

Compliance & Data Security

Master the Consumer Contact-to-Payment Journey with Omnichannel Playbooks!

Discover how consumer “Payment Personas” drive better Omnichannel Communication.

Enhancing Compliance and Efficiency through Omnichannel Approaches

To meet regulatory requirements, like Reg F and ensure operational efficiency, your omnichannel strategy should include robust tracking and monitoring. For instance, avoiding over-contacting customers by tracking communications across all channels—voice, SMS, and email—ensures compliance without limiting engagement.

Using real-time analytics and API triggers also enhances your contact center's ability to personalize interactions, track customer behavior across channels, and maintain compliance.

Key Benefits of an Integrated Omnichannel Approach

Improved Collection Rates: Offering customers their preferred payment and communication options boosts conversion rates. For example, your Intelligent Payment Portal provides a seamless, customer-centric experience that has proven to increase payment completion.

Operational Efficiency: Integrating voice, email, SMS, and chat within a single platform (like your Intelligent Contact Center) reduces agent idle time and improves call management, enhancing overall performance.

Personalization and Segmentation: By segmenting payment personas and providing targeted communication, you can increase engagement and reduce the likelihood of abandoned payments.

Closing the Loop with Payment Personas

Improved Collection Rates: Offering customers their preferred payment and communication options boosts conversion rates. For example, your Intelligent Payment Portal provides a seamless, customer-centric experience that has proven to increase payment completion.

Operational Efficiency: Integrating voice, email, SMS, and chat within a single platform (like your Intelligent Contact Center) reduces agent idle time and improves call management, enhancing overall performance.

Personalization and Segmentation: By segmenting payment personas and providing targeted communication, you can increase engagement and reduce the likelihood of abandoned payments.

Ready to launch a real omnichannel communication and payment strategy?

Our enterprise-level contact center solutions are affordable and a breeze to implement! Have your omnichannel strategy ready in weeks—not months!

Resources

Related Articles & Resources

CASE STUDY