COMPLIANCE | 10 MIN READ

Understanding Regulation F's Model Validation Notice

In an ideal world, debt collectors would have perfect information on the debts they are trying to collect. However, in the real world, there are often errors and ambiguities in the data. This can lead to costly legal disputes and other headaches for all involved.

To help mitigate the risk of inaccurate data, the Consumer Financial Protection Bureau (CFPB) created Regulation F, also known as the Fair Debt Collection Practices Act (FDCPA). One of the key components of this regulation is the Model Validation Notice.

What is the Model Validation Notice

The Model Validation Notice is a blueprint or template the CFPB created that debt collectors can follow when sending initial debt-related communication to a consumer.

Following the MVN provides a debt collector “safe harbor” from potential litigation by outlining the critical components and compliance language required to protect consumers from unfair or deceptive collections.

The letter provides the consumer with specific information about the debt, such as an itemization of the balance owed, the identity and contact information of the debt collector, and the name of the original creditor.

The letter also notifies the consumer of all their legal rights—including how to dispute any of the information contained in the notice.

Some of the benefits of the Model Validation Notice include:

- Mitigates or eliminates the risk of a FDCPA-related lawsuit

- Helps unify the language and layout of validation notices across the debt collection industry

- Gives consumers the opportunity to dispute debt

- Provides consumers with an itemized list of charges owed

When Should Debt Collectors Send the Model Validation Notice?

A debt collector must provide validation information about a debt to a consumer either in the debt collector’s initial communication with the consumer, or shortly thereafter.

This may include situations where the consumer disputes the debt. The amount owed is different from what the creditor reported, or the date of the debt is different from what the creditor reported.

In addition to sending the Model Validation Notice, debt collectors should take steps to ensure the accuracy of the data they are using to collect debts. This may include verifying the information with the creditor, reviewing past collection attempts, and using a credit bureau to verify the debt.

What Does It Mean for Debt Collectors?

The Model Validation Notice is important because it helps to ensure that debt collectors are providing complete and accurate information to consumers. By verifying the debt with the consumer, collection agencies can avoid costly legal disputes and other headaches.

For example, if a debt is invalid, the collector may be required to refund any money that was paid by the consumer. Also, the collector may be subject to civil penalties for violating the FDCPA.

This means that debt collectors must take extra care to make sure of the accuracy of the data they are collecting and that all relevant information is being communicated to a debtor.

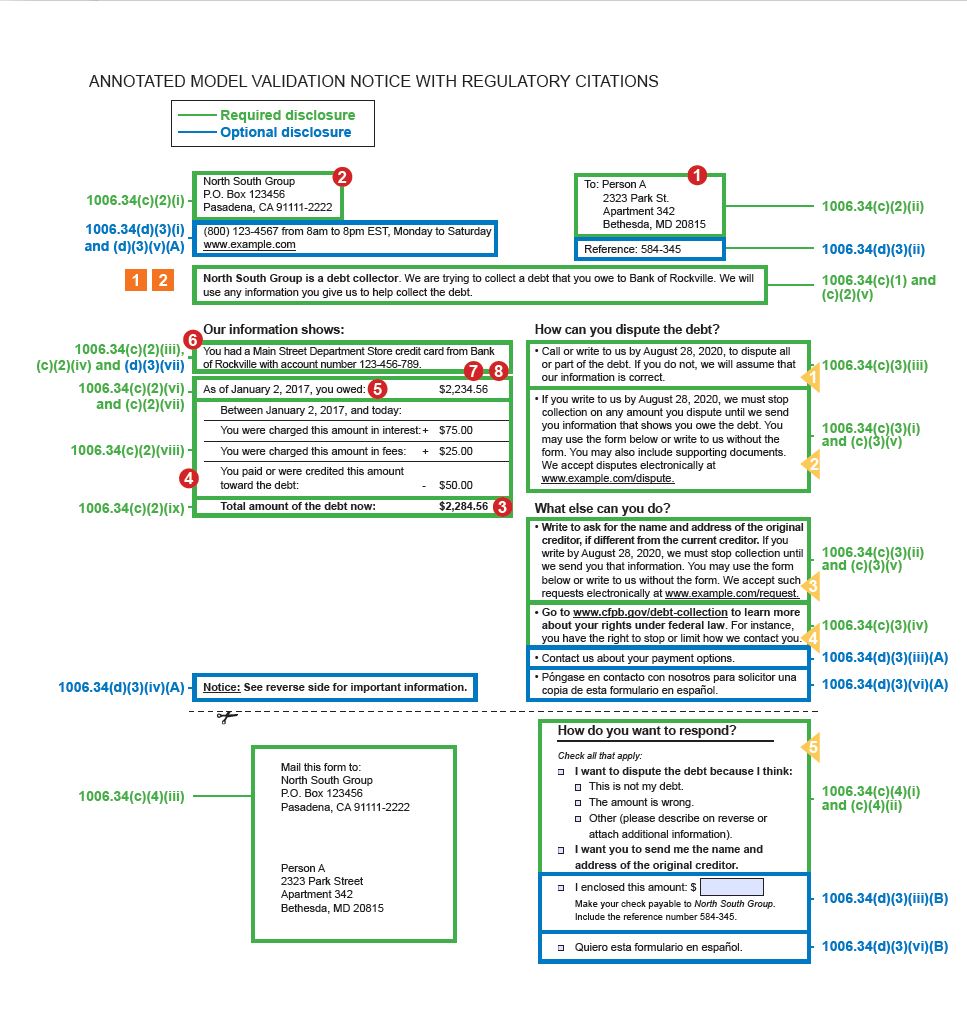

Image courtesy of ACA International

A debt collector must provide validation information about a debt to a consumer either in the debt collector’s initial communication with the consumer, or shortly thereafter.

How Can Collectors Incorporate the Right Practices Into Their Collection Processes?

There are many ways that debt collectors can incorporate the right practices into their collection processes.

- Make sure you have a process for verifying debts. This includes requesting specific information from the consumer and obtaining necessary

- Train your employees on how to verify debts. This includes understanding the requirements of the Model Validation Notice and knowing how to properly request information from the consumer.

- Develop a system for tracking validation requests. This will help you ensure that all requests are properly tracked and that the debt is verified before any collection activities are undertaken.

- Have a plan for responding to disputes. This includes understanding the grounds for disputing a debt and how to properly investigate a dispute.

What Are the Elements of Regulation F’s Model Validation Notice?

The Model Validation Notice has six elements:

The name and contact information of the creditor: This will help the consumer to easily identify the creditor and reach out if they have any questions or concerns.

The amount of the debt: This will help the consumer to understand how much they owe and may make it easier to dispute the debt if they believe that the amount is incorrect.

An itemization or reference date for the debt: The itemization date could reference any of five dates (last statement, the chargeoff, the last payment, the transaction date, or the judgement date). The itemization date is important because it helps to establish when the debt was incurred, and provides greater clarity on the amount owed.

The name and contact information of the collector: The name and contact information of the collector should also be included in the Model Validation Notice. This is not only required by law, but it can also be helpful for the consumer.

A statement that the consumer has the right to dispute the debt: The consumer has the right to dispute the debt. This is an important right, and collectors must take steps to investigate any disputes.

A statement that the collector will stop collection activities until it can verify the validity of the debt: Much like the statement about the right to dispute the debt, this statement assures the consumer that the collector will stop collection activities until it can verify the validity of the debt. This is an important step that collectors should take to guarantee that they are acting within the law.

Is it OK to Email a Validation Notice?

While Validation Notices have been traditionally printed and mailed to consumers, Regulation F also provides crucial guidance on how this information can legally be sent to consumers electronically (email).

Emailing Validation Notices have a number of advantages over printing and mailing. It’s less costly for collectors and more convenient and expedient for consumers.

Closing Notes

While the Model Validation Notice is a helpful tool, it is not perfect. There are some nuances and best practices that collectors should keep in mind when using the notice.

For example, the Model Validation Notice does not specify the grounds for disputing a debt.

Additionally, collectors should be sure to track all validation requests. This will help to make sure that all requests are properly tracked and that the debt is verified before any collection activities are undertaken.

Finally, collectors should have a plan for responding to disputes. This includes understanding the grounds for disputing a debt and how to properly investigate a dispute.

By following these tips, collectors can ensure that they are in compliance with Regulation F and that they are providing the best possible service to consumers.

Want to know more?

Whether you're looking to simplify one part of your collection and compliance process or the whole enchilada, we can help!