HEALTHCARE REVENUE CYCLE | 5 MIN READ

Patient Payment Study Reveals Fundamental Flaws in Healthcare’s Billing Process That Lead to Bad Debt & Bankruptcy

2018 Benchmark Study

The healthcare industry has experienced record or near-record economic distress levels in eight straight quarters

The Polsinelli | TrBK Distress Indices, which use filtered Chapter 11 filings as a proxy to measure financial distress across sub sectors of the economy, reports that health care services has experienced record or near-record highs in each of the last eight quarters.

As the bulk of payment responsibility shifts from payers to patients, providers face a real cash flow dilemma

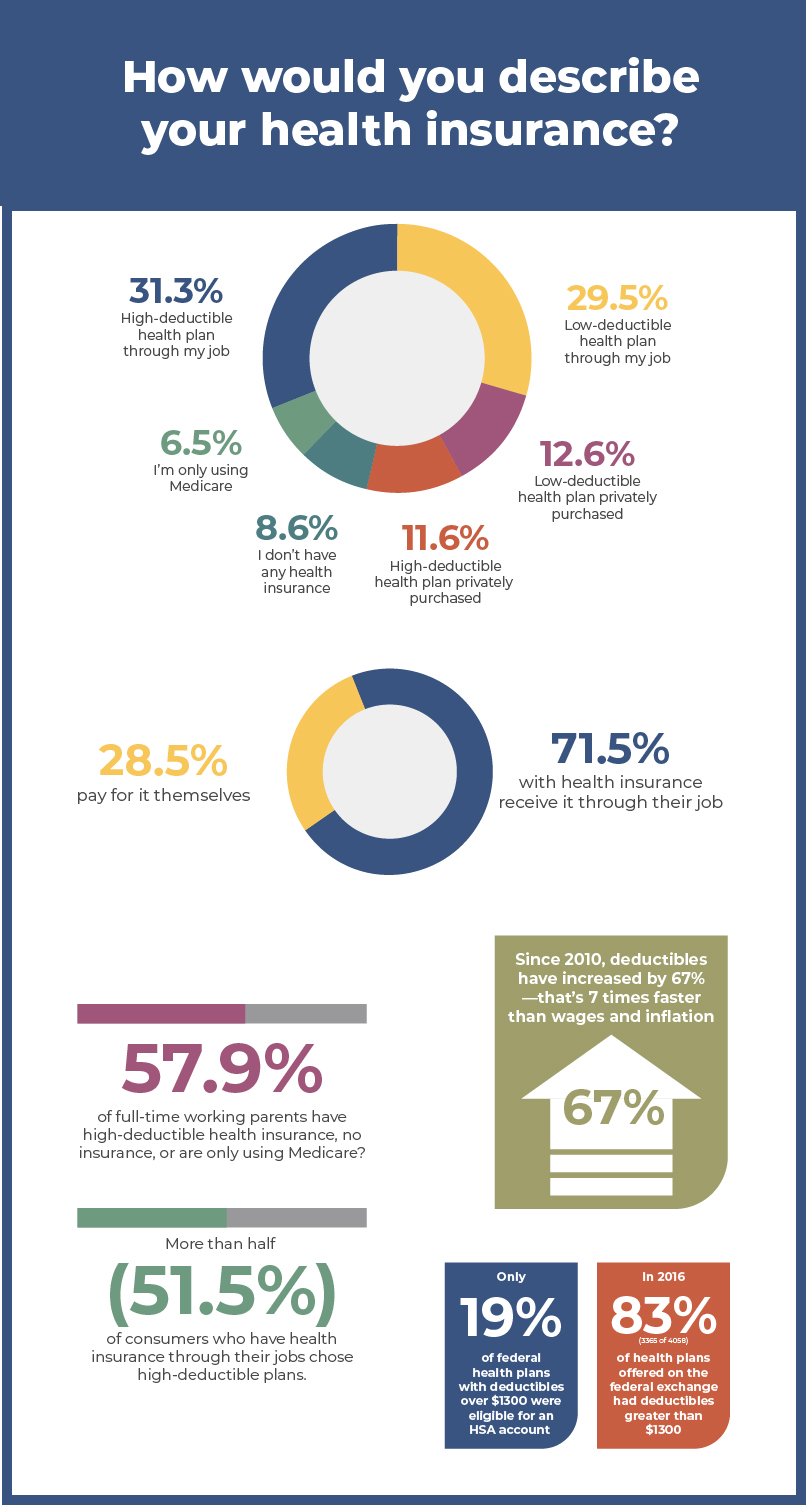

On average, out-of-pocket expenses for insured patients have tripled in just three years—and the impact of those higher costs has been reflected in day sales outstanding and the number of accounts that find their way into medical bill collections.

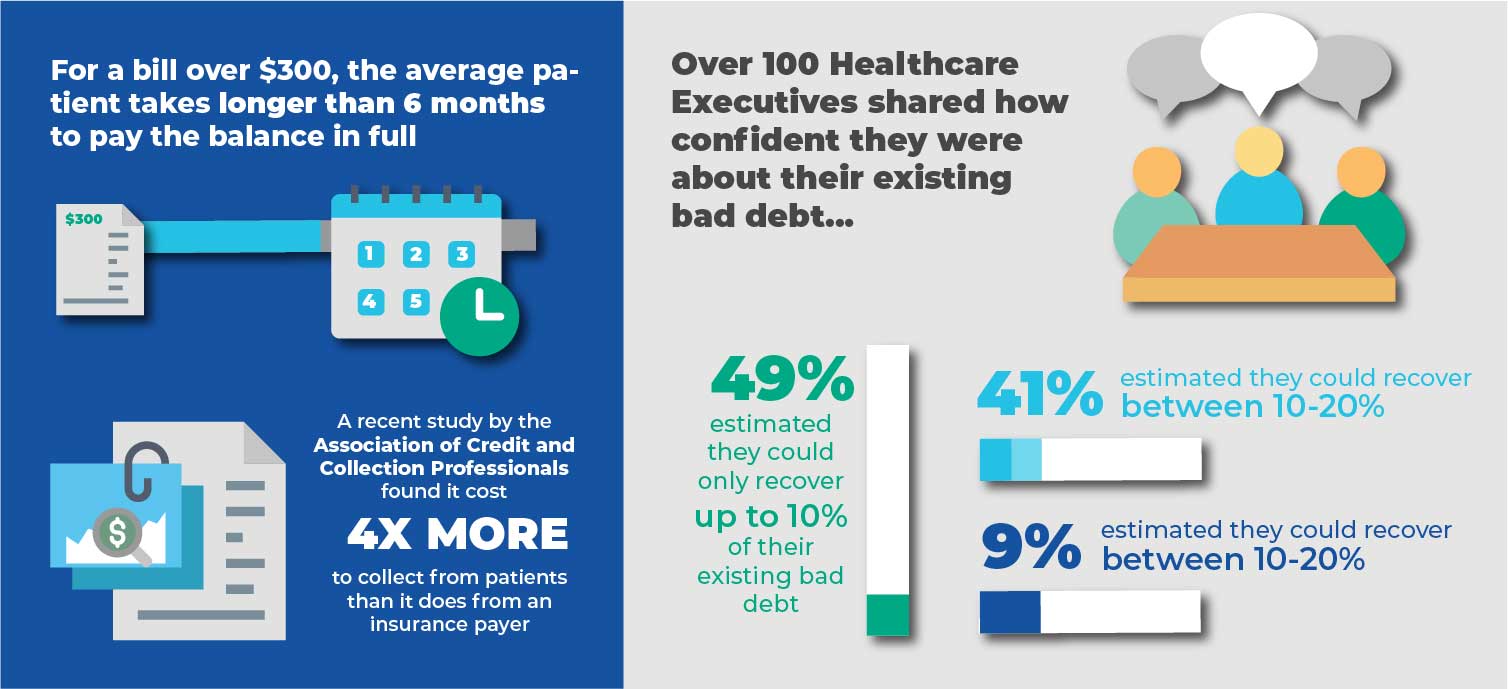

A recent study by the Association of Credit and Collection Professionals found it costs four times more to collect from patients than it does from an insurance company. For a bill over $300, the average patient takes longer than six months to pay their balance in full.

We asked 675 patients how they handled out-of-pocket medical expenses

Since bad debt stemming from the poor, unemployed, or chronically ill typically falls into the category of charity care, we focused our study on adults with full-time jobs and children. This specific segment represents a group hit hardest by healthcare reform, the middle class. Recent studies have indicated that this group makes up a growing segment of the country with unpaid medical bills in the hands of collection agencies.

Some of the questions we intended to answer in the study:

- What role does a patient’s health plan play in how they approach paying a medical debt?

- Are other statistics and studies about the financial impact of rising out-of-pocket costs accurate?

- What can healthcare providers do better to reduce DSOs and bad debt?

How are higher out-of-pocket costs changing how patients pay their medical bills?

Get Our 2019 Patient Payment Study

Resources

Resources & Articles For Managing Your Finances On Your Own

Overcoming Call Blocking and Labeling Challenges in Debt Collection

Reaching right party contacts is hard enough. But when carriers block your calls from getting through to the consumer, or slap the dreaded “Spam Likely” onto your Caller ID, it makes a difficult job nearly impossible. But there’s a solution.

Building a Self-Service Portal that Consumers Want to Use

Creating specific, measurable, achievable, relevant, and time-bound goals are the best way to enhance agent performance, drive customer satisfaction, and ensure agent activities are aligned with your organization’s overall objectives.

What to Know If Your Call Center is Storing Unredacted Call Recordings

Creating specific, measurable, achievable, relevant, and time-bound goals are the best way to enhance agent performance, drive customer satisfaction, and ensure agent activities are aligned with your organization’s overall objectives.