DEBT COLLECTION PAYMENTS | 7 MIN READ

5 Tools to Maximize Debt Collection Revenue During the 2020 Tax Refund Season

Although last year’s average refund of $2,869 was down 1.4% compared to the previous year, it’s still a sizable sum that provides many families a much-needed boost heading into summer.

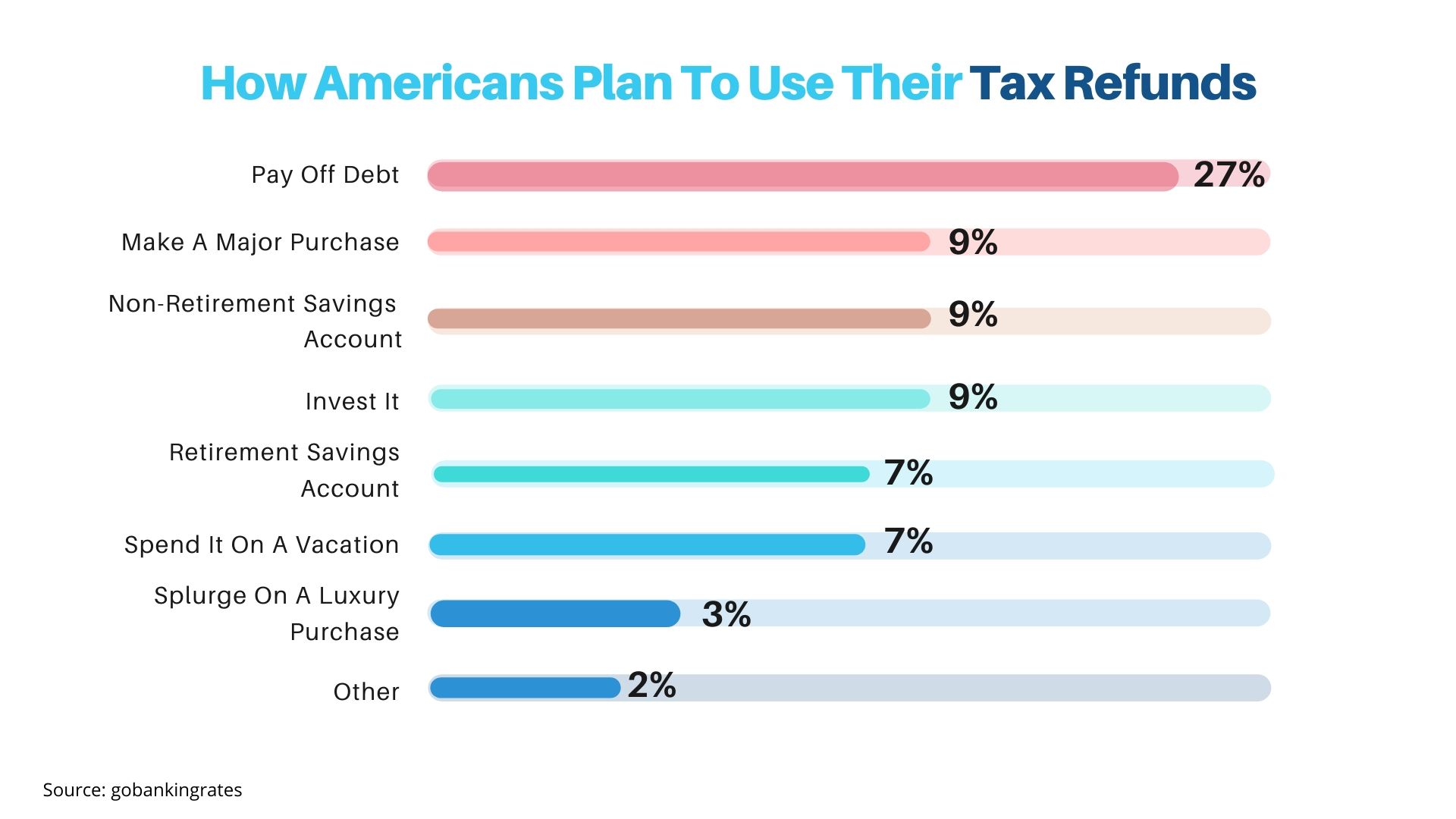

It’s also a time to pay down credit card balances and settle past due balances.

With many creditors and debt collection agencies competing with summer vacation plans and the newest iPhone for this sudden influx of cash, timing is everything.

But to truly take advantage of this short tax season collection window, you’ll need to have your strategy in place.

Increasing call volume and mailings isn’t a strategy—you need the tools and technology that allow you to work smarter, not harder

Here’s 5 tools that act like “people multipliers” and every agency should have at their disposal

Propensity-To-Pay Model—predicts whether payment is likely from a delinquent consumer.

Liquidation Model—analyzes historical data to inform the expected value of accounts.

Omnichannel Model—Identifies the highest-yielding form of communication.

Time-Of-Day Model—matches each consumer with a preferred time to be called.

Every collection agency increases phone calls and mailings (on average 25%) during tax season. That’s standard operating procedure—it’s not a strategy. A strategy is optimizing this increase in activity to take full advantage of the tax season window.

Ready to collect your money?

Whether you’re looking to improve one area of your debt collection department or the whole enchilada, we can help!

Resources

More Articles Related to Patient Communication

Why Siloed Systems Are Costing You: The Case for Platform Consolidation

Discover how siloed communication and payment platforms can lead to inefficiencies, missed revenue, and compliance issues. This article explains why modern agencies need to consolidate operations and manage the entire consumer journey within one unified platform. Intelligent Contacts’ integrated solution combines a Hosted Contact Center and a self-service payment portal to streamline operations, maintain compliance, and improve ROI. Learn how to stay ahead in 2025 by embracing an integrated, consumer-centric approach to communication and collections.”

What the ARM Industry Needs to Know as Federal Student Loan Collections Resume

After a multi-year pause initiated during the COVID-19 pandemic, the U.S. Department of Education has confirmed that collections on defaulted federal student loans will resume on May 5, 2025. This shift carries significant implications for the ARM industry — especially those engaged in debt recovery for educational and government portfolios. With nearly 10 million borrowers expected to be in default and only 38% of borrowers currently in active repayment, the market is poised for a large-scale operational resurgence.

CFPB Revokes Controversial Medical Debt Advisory Opinion in Response to Industry Pushback

In a major win for the accounts receivable and collections industry, the Consumer Financial Protection Bureau (CFPB) announced that it will revoke its controversial advisory opinion on medical debt collection, originally slated to go into effect in January 2025. The decision comes after significant legal challenges and lobbying efforts led by ACA International and other stakeholders.