FDCPA COMPLIANCE | 10 MIN READ

Court Ruling Makes Payment Portals a New Target of FDCPA-Focused Lawsuits

* The information in this article is not intended as legal advice, nor should it be taken as such. The compliance solutions mentioned below should be implemented based upon the recommendations of your own legal counsel.

Court Rules 3rd-Party Payment Portals Are ‘Communication in Connection with the Collection of a Debt'

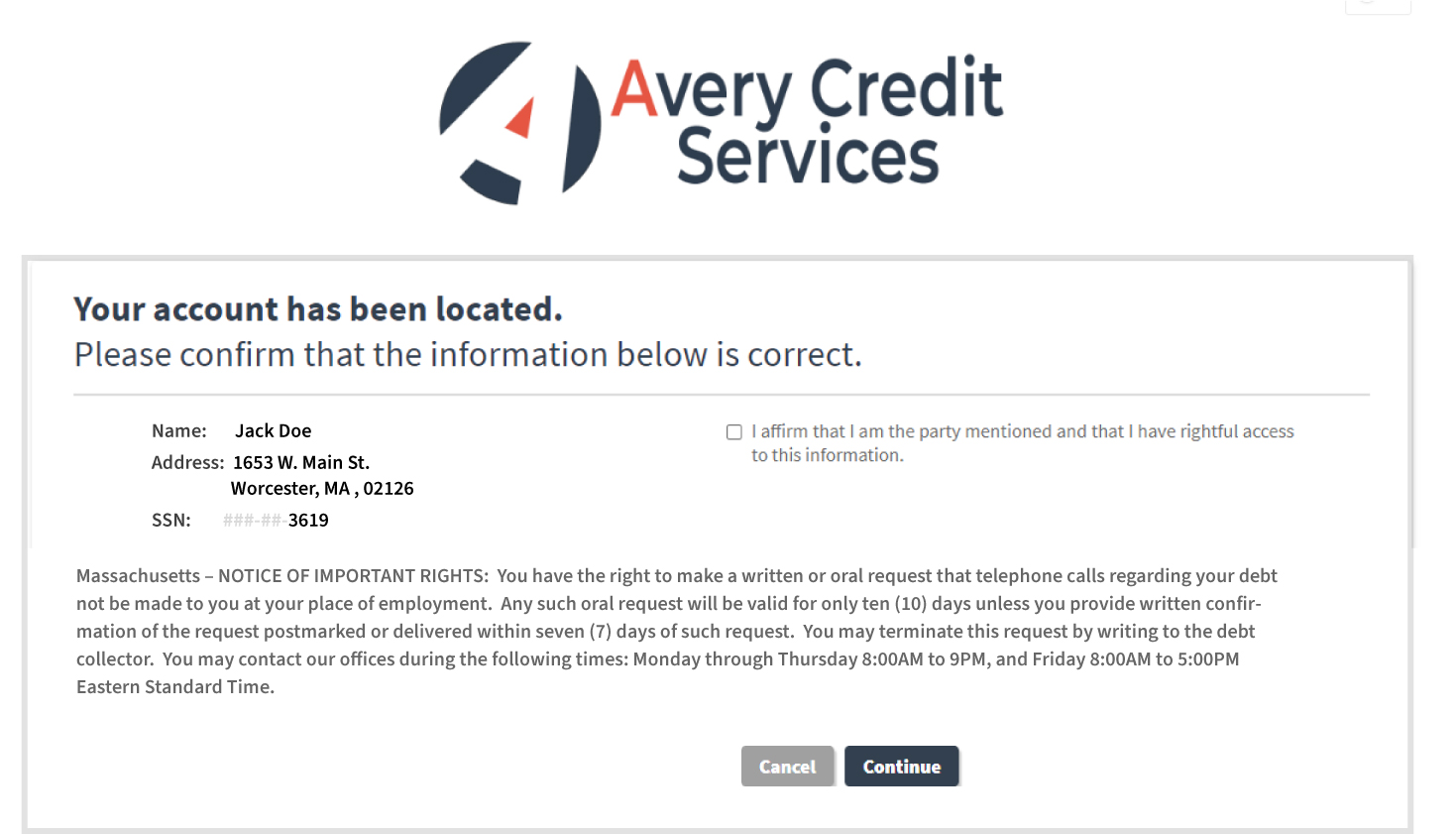

Letting debtors pay online, or “self-resolve” their accounts through a payment portal, are good for all parties. However, as recent litigation has revealed, payment pages and payment portals have now become major targets for FDCPA-related lawsuits. Several courts have ruled an online payment site can be considered “communication in connection with the collecting of a debt.”

Orneal v. Midwest Recovery Systems LLC

Odneal then filed an action claiming the defendant violated the FDCPA by failing to disclose time-barred debt language on the site. Without the required legal disclosures about his time-barred debt, the plaintiff claimed claimed, he could have unknowingly revived the debt by making a payment.

Adding to the legal dilemma, the defendant wasn't directed to the payment portal by Midwest Recovery. he got there through a Google search. The defendant's motion to dismiss the case on the grounds the payment portal wasn't “debt communication” as defined by the FDCPA, was denied by the court.

The Court, applying the FDCPA's very broad “trickery standard,” denied the defendant’s motion, explaining it is plausible that a payment portal satisfies the definition of a communication under the FDCPA (the conveying of information regarding a debt directly or indirectly to any person through any medium).

Since this ruling, the Central District of Illinois alone have issued three decisions related to debt collection websites in favor of “confused and misled” consumers.

This is how United States District Judge James E. Shadid summarized in Tinsley v. Consumer Adjustment Co:

“Plaintiff has plausibly alleged Defendants carefully crafted a deceptive means to collect stale debts by reporting those debts to credit reporting agencies and creating a payment portal knowing unsuspecting debtors would find their way to its website. By doing so, Plaintiff alleges Defendant purposely skirted the disclosure requirements discussed in McMahon and Pantoja. These allegations are consistent with the Seventh Circuit's statement in Pantoja that “the FDCPA prohibits a debt collector from luring debtors away from the shelter of the statute of limitations without providing an unambiguous warning that an unsophisticated consumer would understand.”

James E Shadid

US District Judge

3 FDCPA Compliance Risks Our Dynamic Disclosures Tool Solves

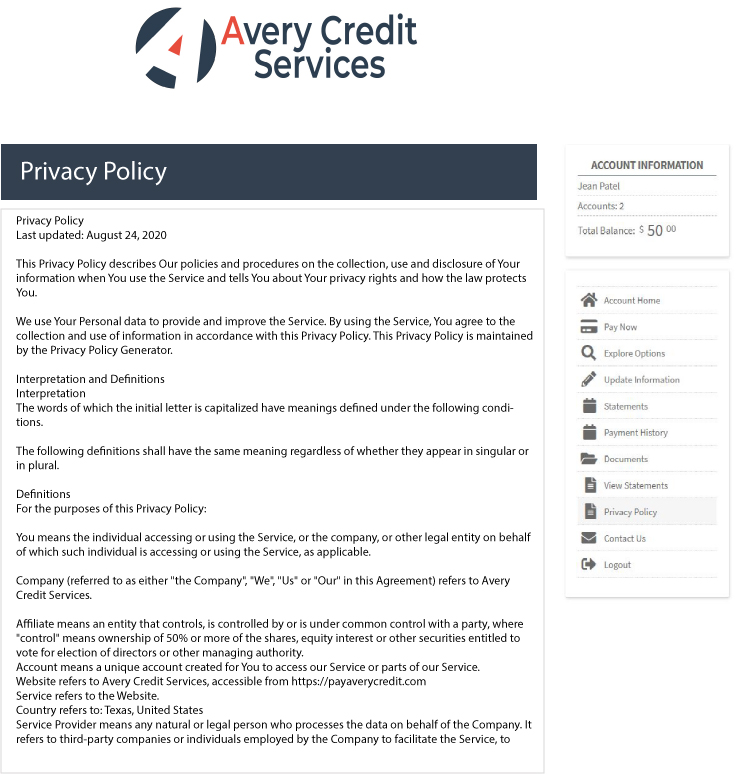

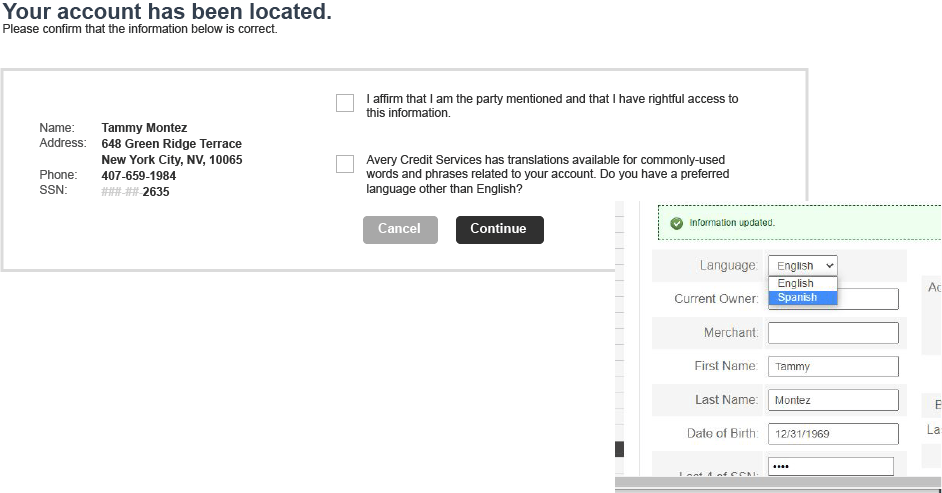

This is particularly important for payment portals, where specific debt-related details are presented to a consumer once they enter an account number or PIN. This is where account-specific verbiage (like state or time-barred legal disclosures) must be shown.

Static Terms & Disclosures — These are legal disclosures that should be shown to all consumers.

- Mini Miranda

- Updated Terms & Conditions (Printable)

- State Disclosures (for Communication with Consumers)

- State Disclosures (Statute of Limitations | Time-Barred Debt)

- Types of Data Collected

- Tracking Technology (Cookies)

- Use of Personal Data

- Retention of Personal Data

- Transfer and Disclosure of Personal Data

New York City's New Debt Collection Rules — requires debt collectors (both creditors and collection agencies) to include on any public-facing websites maintained by the debt collector, information regarding the availability of any language access services provided by the debt collector. The law is also requiring DCAs to ask consumers about their preferred language and track their responses.

Want to know how our Intelligent Payment Portal keeps consumer communication compliant with changing regulations ?

Resources

More Articles Related to Compliance

Why Siloed Systems Are Costing You: The Case for Platform Consolidation

Discover how siloed communication and payment platforms can lead to inefficiencies, missed revenue, and compliance issues. This article explains why modern agencies need to consolidate operations and manage the entire consumer journey within one unified platform. Intelligent Contacts’ integrated solution combines a Hosted Contact Center and a self-service payment portal to streamline operations, maintain compliance, and improve ROI. Learn how to stay ahead in 2025 by embracing an integrated, consumer-centric approach to communication and collections.”

What the ARM Industry Needs to Know as Federal Student Loan Collections Resume

After a multi-year pause initiated during the COVID-19 pandemic, the U.S. Department of Education has confirmed that collections on defaulted federal student loans will resume on May 5, 2025. This shift carries significant implications for the ARM industry — especially those engaged in debt recovery for educational and government portfolios. With nearly 10 million borrowers expected to be in default and only 38% of borrowers currently in active repayment, the market is poised for a large-scale operational resurgence.

CFPB Revokes Controversial Medical Debt Advisory Opinion in Response to Industry Pushback

In a major win for the accounts receivable and collections industry, the Consumer Financial Protection Bureau (CFPB) announced that it will revoke its controversial advisory opinion on medical debt collection, originally slated to go into effect in January 2025. The decision comes after significant legal challenges and lobbying efforts led by ACA International and other stakeholders.