STATEMENTS | 10 MIN READ

The Big Problem With Managing Reg F Communication Limits By Phone Number

The CFPB's November 2020 Final Rule (Reg F) was one of the most significant compliance regulations handed down in decades. On the one hand, having specific rules that outline how often a debt collector can call, email, or text, a consumer is incredibly important for compliance and legal teams.

On the other hand, implementing these new rules into existing technology and collection processes has been a painful, year-long journey for businesses and software vendors.

What is Regulation F?

- Places new and specific limitations on how (and how often) a debt collector can contact a consumer about a debt

- Requires debt collectors to track both “contacts” and “communications” separately

- Provides specific opt-in/opt-out requirements prior to emailing or texting a consumer

- Went into effect Nov. 30, 2021.

What We're Learning About Post Reg F Communication

For many businesses and technology providers, the obvious way to manage Reg F was to track communications and contacts by phone number. Count how many calls or communication attempts were made to a specific number in a specified time period. Then stop communication to that number until it's legal to resume.

However, as many companies are now realizing after just a few months of Reg F dialing, call volume has dropped more than anticipated. Contact lists that should take the entire work day, are exhausted by mid-afternoon. What happened?

Restricting by Phone Number May Be Preventing Legal Communication From Taking Place

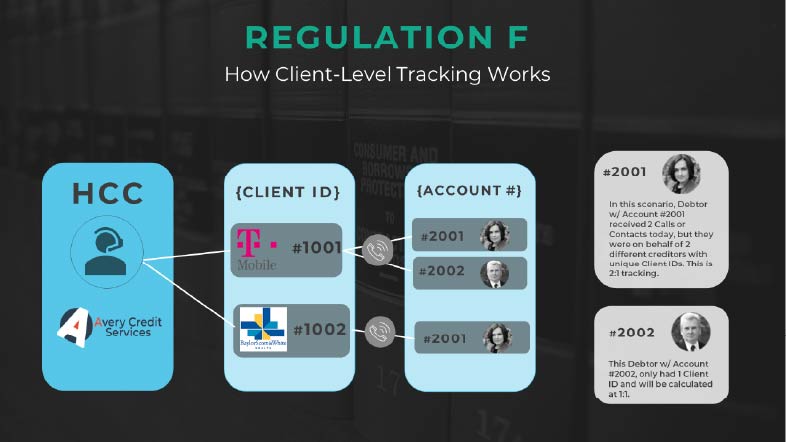

While some reduced call volume was to be expected, but one of the major issues we realized during our conversations was that many agencies are actually restricting calls to consumers who they still legally can contact under Reg F. How is this happening? Their collection software or dialer is tracking and restricting calls based on phone number.

What if a consumer has multiple accounts?

What happens when you’re calling the same consumer on behalf of multiple creditors?

Reg F restrictions are tied to a debt, not a phone number. So, potentially 10-20% of the numbers your system is making ineligible, could still called on behalf of another account or creditor.

Tracking Reg F by Account Number or Client Will Prevent Legal Communication

Reg F restrictions are tied to a debt, not a phone number. So, potentially 10-20% of the numbers your system is making ineligible, could still called on behalf of another account or creditor.

Since almost all of our clients are calling on behalf of multiple creditors or attempting to contact consumers with multiple accounts in collections, we built our system to track calls by creditor or account, not by phone number. This approach maintains Reg F compliance without needlessly blocking calls you can legally be making.

How Our Intelligent Contacts' Cloud Contact Center Platform Uses Client or Account-Level Tracking to Maximize Contacts and Communications

With tax refund season about to be in full swing, we want to make sure your agency isn’t leaving any money on the table! Check to see if the system you’re using to manage Reg F has the ability to track contacts and communications by account or creditor.

If not, now is the perfect time to give Intelligent Contacts a try! We understand that time is money and can have you up and running quickly.

Are you ready for this year's tax refund season?

We understand that time is money and can have you up and running quickly.