HEALTHCARE REVENUE CYCLE | 5 MIN READ

Patient Payment Study Reveals Fundamental Flaws in Healthcare’s Billing Process That Lead to Bad Debt & Bankruptcy

2018 Benchmark Study

The healthcare industry has experienced record or near-record economic distress levels in eight straight quarters

The Polsinelli | TrBK Distress Indices, which use filtered Chapter 11 filings as a proxy to measure financial distress across sub sectors of the economy, reports that health care services has experienced record or near-record highs in each of the last eight quarters.

As the bulk of payment responsibility shifts from payers to patients, providers face a real cash flow dilemma

On average, out-of-pocket expenses for insured patients have tripled in just three years—and the impact of those higher costs has been reflected in day sales outstanding and the number of accounts that find their way into medical bill collections.

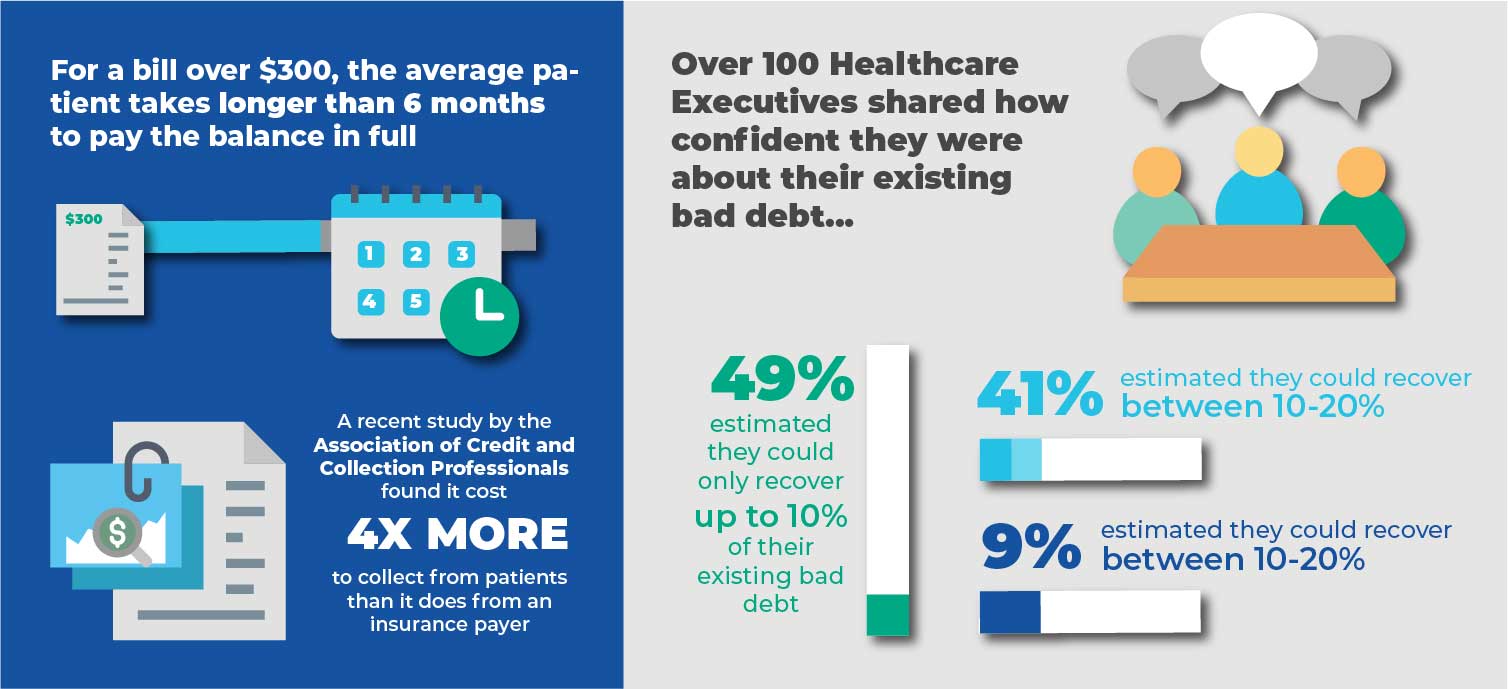

A recent study by the Association of Credit and Collection Professionals found it costs four times more to collect from patients than it does from an insurance company. For a bill over $300, the average patient takes longer than six months to pay their balance in full.

We asked 675 patients how they handled out-of-pocket medical expenses

Since bad debt stemming from the poor, unemployed, or chronically ill typically falls into the category of charity care, we focused our study on adults with full-time jobs and children. This specific segment represents a group hit hardest by healthcare reform, the middle class. Recent studies have indicated that this group makes up a growing segment of the country with unpaid medical bills in the hands of collection agencies.

Some of the questions we intended to answer in the study:

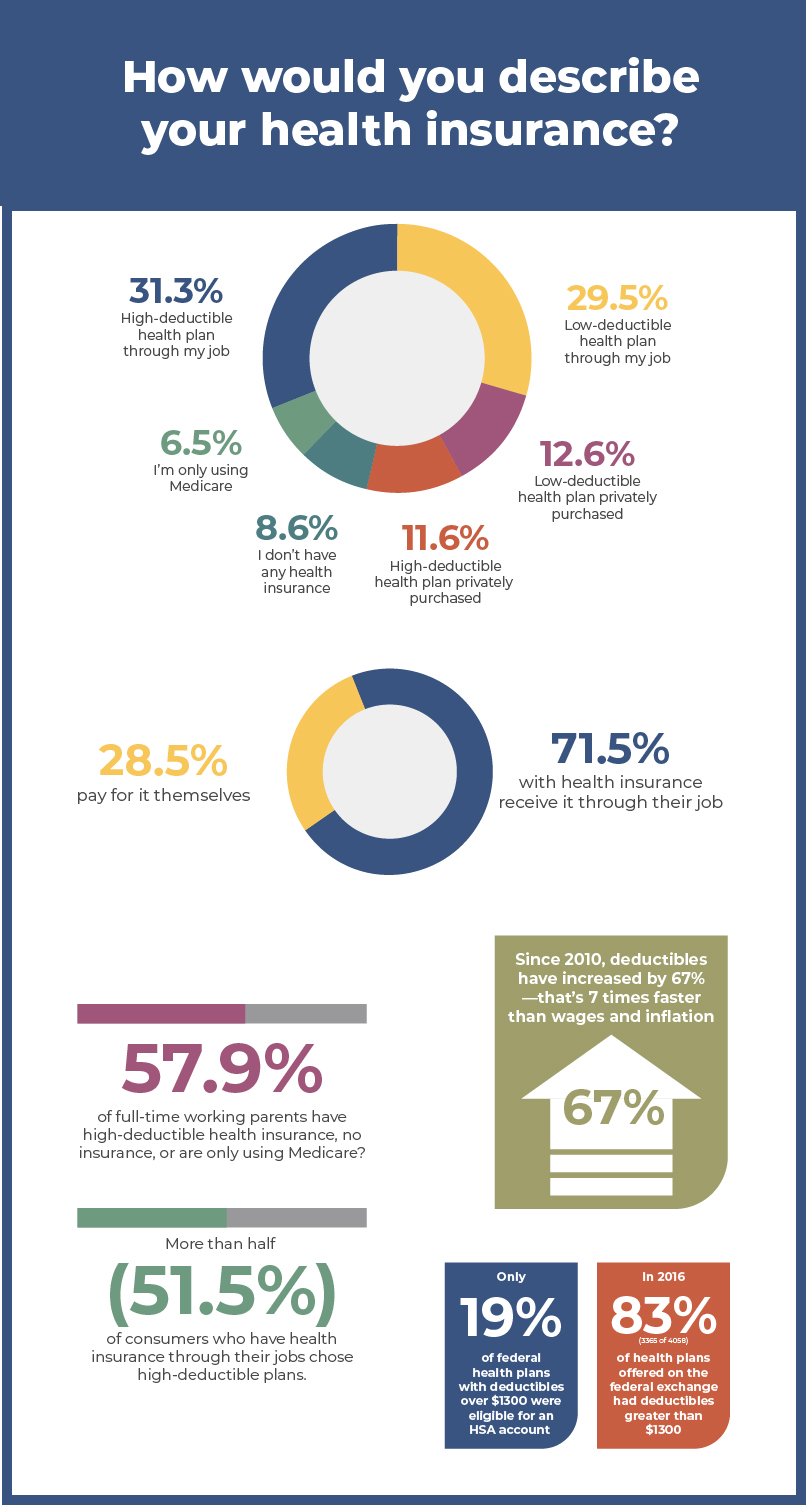

- What role does a patient’s health plan play in how they approach paying a medical debt?

- Are other statistics and studies about the financial impact of rising out-of-pocket costs accurate?

- What can healthcare providers do better to reduce DSOs and bad debt?

How are higher out-of-pocket costs changing how patients pay their medical bills?

Get Our 2019 Patient Payment Study

Resources

Resources & Articles For Managing Your Finances On Your Own

Why Siloed Systems Are Costing You: The Case for Platform Consolidation

Discover how siloed communication and payment platforms can lead to inefficiencies, missed revenue, and compliance issues. This article explains why modern agencies need to consolidate operations and manage the entire consumer journey within one unified platform. Intelligent Contacts’ integrated solution combines a Hosted Contact Center and a self-service payment portal to streamline operations, maintain compliance, and improve ROI. Learn how to stay ahead in 2025 by embracing an integrated, consumer-centric approach to communication and collections.”

What the ARM Industry Needs to Know as Federal Student Loan Collections Resume

After a multi-year pause initiated during the COVID-19 pandemic, the U.S. Department of Education has confirmed that collections on defaulted federal student loans will resume on May 5, 2025. This shift carries significant implications for the ARM industry — especially those engaged in debt recovery for educational and government portfolios. With nearly 10 million borrowers expected to be in default and only 38% of borrowers currently in active repayment, the market is poised for a large-scale operational resurgence.

CFPB Revokes Controversial Medical Debt Advisory Opinion in Response to Industry Pushback

In a major win for the accounts receivable and collections industry, the Consumer Financial Protection Bureau (CFPB) announced that it will revoke its controversial advisory opinion on medical debt collection, originally slated to go into effect in January 2025. The decision comes after significant legal challenges and lobbying efforts led by ACA International and other stakeholders.