REVENUE CYCLE | 10 MIN READ

How Capturing Credit Card on File at Patient Intake Shortens DSO, Reduces Bad Debt, and Cuts AR Costs

Drastic Shift in Responsibility to Patients Demands Proactive Accounts Receivable Strategies

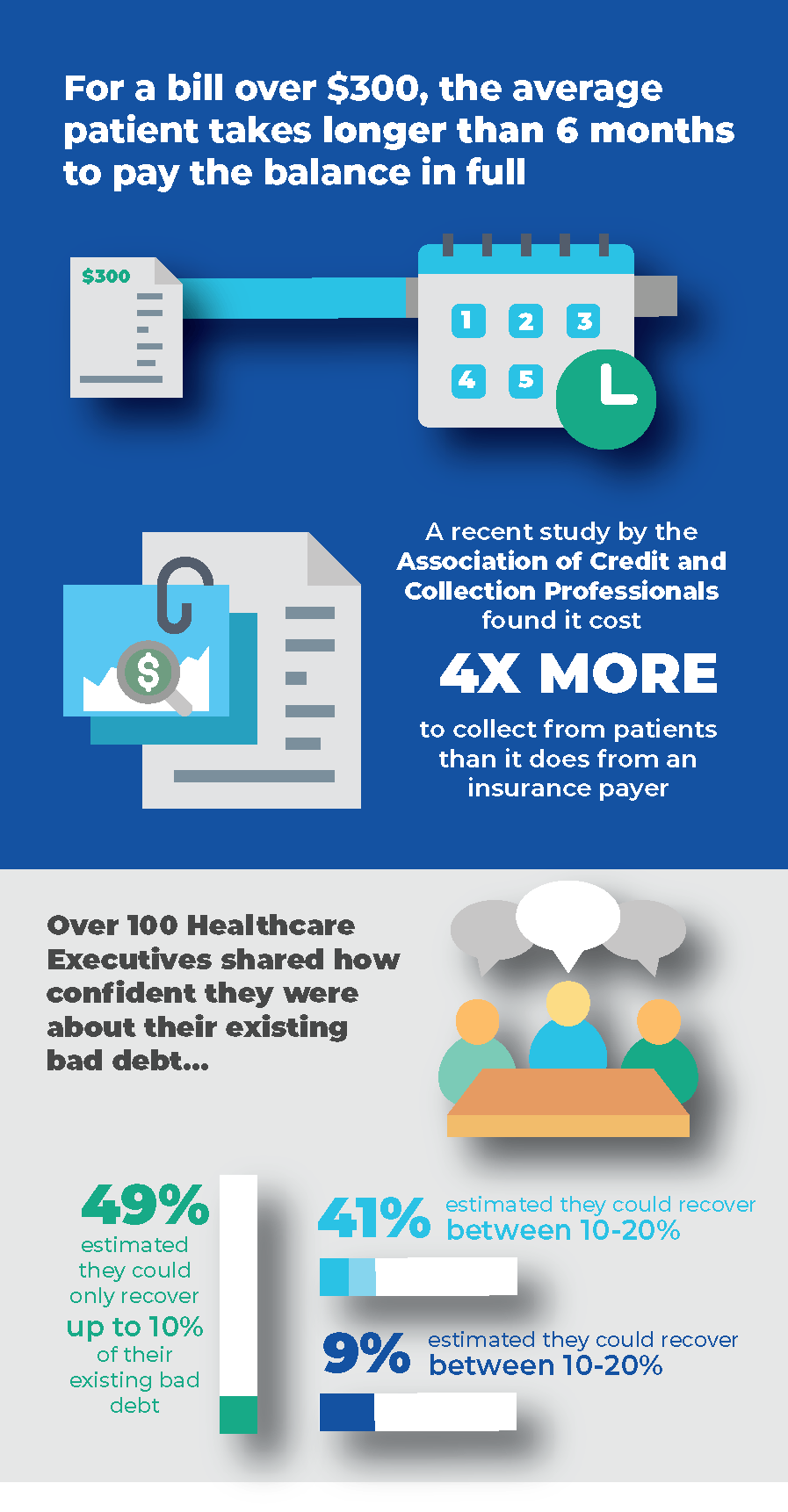

Bad debt has long been considered a necessary evil to healthcare providers. There will always be a percentage of costs that will go uncompensated, and either designated as charitable care, or written off as bad debt. However, providers could always count on recovering the majority of revenue from insurance payers and government programs (Medicare and Medicaid).

That being the case, healthcare's revenue cycle has traditionally focused on perfecting and automating the hard science of medical billing and coding, insurance verification, and claims and denial management.

However, the ripple effect from 2010's Affordable Care Act has completely altered the financial landscape for healthcare providers by making patients the new payer. In just the last three years, patient cost sharing has increased from 10% to 30% on average annually.

The constantly evolving science of collecting from payers is still a critical part of the revenue cycle, however, the most accurate and effective coding and claims denial processes are now recovering 20% less of medical costs.

Many providers are finding out too late that the traditional patient billing process is not working on higher balances and significantly more needed revenue is speeding its way towards third-party collections—the last stop before bad debt.

Preparing Patients for Higher Out-Of-Pocket Costs is Essential—But Securing a Payment Method Prior to Service is a Gamechanger

67% of baby boomers, 78% of Gen X and 89% of millennials use subscription services that are known to store credit card information.

People are used to storing payment information online.

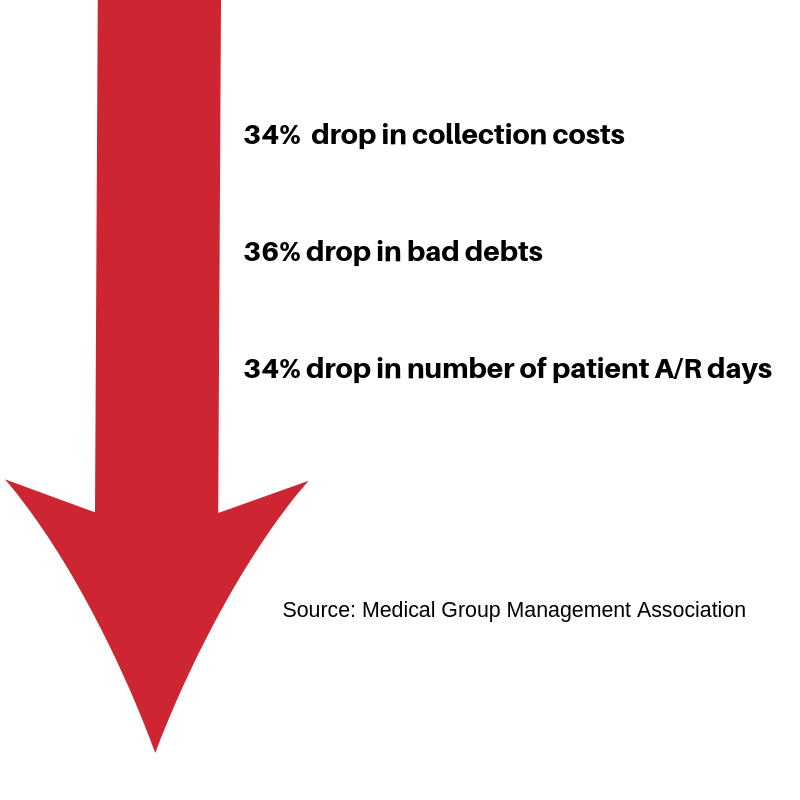

Additionally, there is research to back this up and examples of how credit card on file solutions are dramatically reducing bad debt. Let's take a big picture view of it all.

The concept of implementing a credit card on file (CCOF) system tends to trigger questions from some providers. Fortunately, there are answers.

Am I taking an unnecessary security or compliance risk with a CCOF system? Not if you work with a reputable partner with compliance/security certifications and a high-grade PCI DSS Level 1 certification.

What about legal concerns?

A CCOF is completely legal because it counts as protected healthcare data.

Making the CCOF Results YOUR Results

“Why shouldn't it be an expectation that a patient pays their bills and not determine how much they can pay us each month?” she asked.

It's a small practice, but it's the principle that counts. They needed money to come in at a faster rate so they could survive. Bigger systems need a faster rate of payments in order to avoid sending debt to a collections company where it may never get paid.

Making Credit Card on File Work For You

- It will create a faster check in and out process

- You reduce the stress of sending bad debt to collections

- It's secure, and it provides patients with a managed billing plan

- Empowering patients to make payments eliminates concerns about that bill

- The credit card on file eliminates questions about patient payment methods

- Make it easy to communicate this change to staff and patients

- Make it easy for patients to securely save their card information in the portal

- Find a credit card on file solution that combines compliance, a branded payment portal, and encryption-based data security.

- Why allow bad debt to get older and take the same risks with new debt? Take the first step towards inspiring your patients to make payments and empowering your practice to improve revenue cycles.

Can we help you succeed in a consumer-driven healthcare industry?

Whether you're looking to improve one area of patient communication or the whole enchilada, we can help!

Resources

More Articles Related to Patient Communication

Why Your Contact Center Numbers Keep Getting Flagged as Spam, and What to Do About It in 2026

The Shift Splitting Split Market Leaders From Legacy Players in 2026

How Virtual Negotiation Increases Payment Rates: The Psychology Behind Letting Customers Set Their Own Terms

The Shift Splitting Split Market Leaders From Legacy Players in 2026

5 Ways AI Agents Are Quietly Revolutionizing Client Satisfaction

The Shift Splitting Split Market Leaders From Legacy Players in 2026