COMMUNICATION | 10 MIN READ

10 Tips That Will Make Your Customers Happy to Pay You

“Acquiring a new customer is five times as expensive as retaining an existing customer.” – Harvard Business Review (HBR)

So, is it even possible to collect from customers and actually make them happy to do it?

1) You will try to understand why the customer has chosen you

Don’t forget that your current customer has already gone through the sales cycle. He has been through the full sales cycle and the service has convinced him. Therefore, reinforce his choice when you re-launch him! Used wisely, the time to cash out is a good opportunity to maintain customer relationships.

2) You will show your client that you are listening to him or her

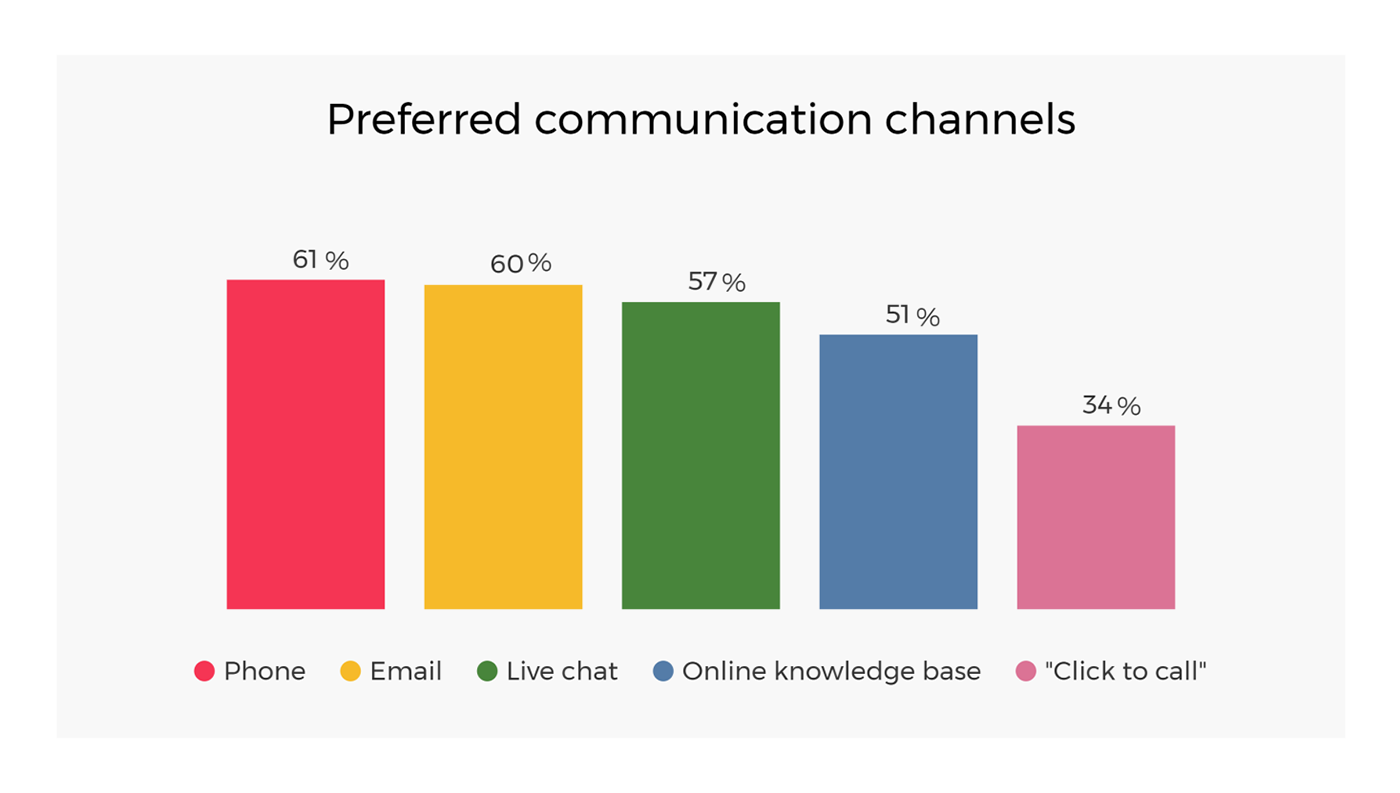

3) You will show that you are attentive to the means of interaction that he or she favors

4) You will have an in-depth understanding of your client’s purchasing and payment channels

5) You will understand that there are individuals behind the company

6) You may want to consider setting up client advisory committees (CACs)

Bevin Maguire and Jane Hiscok explain that they have implemented such committees in their respective companies, IBM and the Farland Group. These committees are very beneficial to them, as they allow them to gather valuable information about their clients’ activities and priorities. They can then improve their go-to-market strategy and approach, while strengthening relationships with their customers. If you have the human, time and financial means to implement them, they will be a real asset.

7) You will detect risks before maturity

8) You will sometimes use the human relationship as a means of pressure

Quantify the cost of late payments and put your cards on the table. For example, say, “Our company makes 600,000 dollars a year in turnover with your company. On average, you pay with a delay of 15 days. It may seem trivial to you, but it generates a permanent cash flow gap of 25,000 dollars for us… And we are obliged to finance it by factoring. This costs us 2,000 dollars a year.” We would simply like to make you understand that a small structure like that cannot absorb such costs.

9) You will use the human relationship to establish a long-term vision of the business relationship

10) You will put in place measures to speed up the collection process

All in all, it is now more important than ever to build long-lasting and prosperous business relationships. All the more so in a context of strong competition and the automation of companies, where perpetual hunting for new customers can be very costly. We hope that these few tips will help you make the collection process more favorable for your company and for the customer.

Is Patient Engagement More Than Just a Buzzword to You?

Whether you're looking to improve one area of patient communication or the whole enchilada, we can help!

Resources

More Articles Related to Patient Communication

Why Your Contact Center Numbers Keep Getting Flagged as Spam, and What to Do About It in 2026

The Shift Splitting Split Market Leaders From Legacy Players in 2026

How Virtual Negotiation Increases Payment Rates: The Psychology Behind Letting Customers Set Their Own Terms

The Shift Splitting Split Market Leaders From Legacy Players in 2026

5 Ways AI Agents Are Quietly Revolutionizing Client Satisfaction

The Shift Splitting Split Market Leaders From Legacy Players in 2026