DATA SECURITY & COMPLIANCE | 10 MIN READ

What is P2PE?

How Point-To-Point Encryption Solves PCI-Compliance Concerns

What is Point-To-Point Encryption?

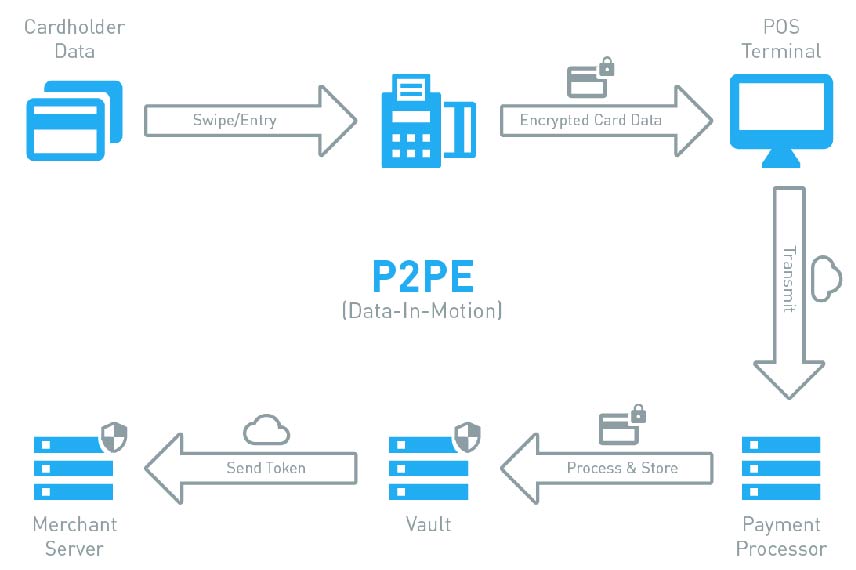

Each device is individually injected with an encryption key unique to the merchant. This carefully-controlled process takes place off-site at an approved Hardware Security Module (HSM). Once completed, these PCI-certified devices are then securely shipped to the merchant.

What’s the benefit of using a P2PE device?

Once card data is keyed into a merchant’s computer, the company’s whole network becomes “in scope” for PCI auditing and compliance standards. As PCI compliance guidelines and requirements become more complex and costly, P2PE devices offer a quick and relatively inexpensive solution.

P2PE solves PCI compliance issues because cardholder data is keyed directly into the device, where it’s encryped before ever hitting the merchant’s computer, network, or servers.

“Our solution prevents clear-text cardholder data from ever being present in our clients’ network. That means their customer’s credit card data isn’t accessible in the event of a data breach. This also removes our clients computers and servers out of scope for PCI compliance.

Jeff Mains

CEO, Intelligent Contacts

Our PCI-Certified P2PE devices undergo the most extensive security measures?

Once the unique encryption key has been injected, our certified devicesare designed to detect tampering. If malicious activity is detected, the device is automatically deactivated, preventing a breach.

“While there are other providers offering solutions as “end-to-end encryption solutions,” most are non-validated P2PE products. Only P2PE solutions listed on the PCI-SS website have been audited and approved by the Payment Card Industry Council.”

Jeff Mains

CEO, Intelligent Contacts

How our P2PE solutions reduce PCI compliance requirements

Our PCI-approved P2PE devices are fully-integrated with our merchant gateway and virtual terminal. All transactions can be managed and reconciled in one place, or sent to your system of record (collection software, EHR, CRM) through our Rest API or sFTP.

Looking to solve yearly PCI compliance headaches with one call! We can help!

Resources

More Articles Related Consumer Payments

Overcoming Call Blocking and Labeling Challenges in Debt Collection

Reaching right party contacts is hard enough. But when carriers block your calls from getting through to the consumer, or slap the dreaded “Spam Likely” onto your Caller ID, it makes a difficult job nearly impossible. But there’s a solution.

Building a Self-Service Portal that Consumers Want to Use

Creating specific, measurable, achievable, relevant, and time-bound goals are the best way to enhance agent performance, drive customer satisfaction, and ensure agent activities are aligned with your organization’s overall objectives.

What to Know If Your Call Center is Storing Unredacted Call Recordings

Creating specific, measurable, achievable, relevant, and time-bound goals are the best way to enhance agent performance, drive customer satisfaction, and ensure agent activities are aligned with your organization’s overall objectives.